Welcome to this newsletter, aimed at revisiting the events of the past 21 days in the NFT world and sharing my latest updates in coding, art, and data. On the agenda :

Editorial: Why On-Chain Sales Matter

NFT Market Analysis

My NFT Valuator on Dune

Experimental onchain art: PostMortem World

I hope you enjoy the read! Feel free to share your feedback or leave comments.

On-chain Sales Matter

It seems obvious: we use blockchain and smart contracts to eliminate trusted intermediaries. This is even more crucial in industries known for their opacity and questionable practices—like the art market, for instance.

So, what should we think when, in February 2024, 10 Autoglyphs were transferred to a new wallet and hailed by specialized media as "one of the largest on-chain digital art transactions"? No, Matt Medved, this is not a sale. These are two transfers. But don't worry, Matt, you're not alone in this: on November 18, 2024, Autoglyph #239 was transferred from J1mmy's Vault to the "Curated Vault 3." What a shame to hide this grail—what was there to conceal behind this pseudo-transaction? The buyer's identity? The amount? Regardless of what either party says, the blockchain doesn't lie. And you know this very well, gentlemen.

These two examples highlight a trend that has emerged over the past few years, particularly from traditional auction houses like Christie's or Sotheby's. So many sales that will never be visible on-chain, undermining the ethical use of NFTs in the art world—and by extension, the broader relevance of NFTs in other sectors beyond short-term profit.

NFT Market Analysis

So, are we back?! I hope you didn't stop at the usual collections that have been topping the charts for years to reach that conclusion!

I’ve made a small update to my NFT market sales dashboard: I’ve added the top 10 collections from the Ronin blockchain. My data is based on research by Hashed, but it’s incomplete when it comes to buyers... Since only unique wallet data is available, it’s hard to make a difference between buyers and sellers.

I won’t dwell on the evolution of the main PFP collections that have occupied the top 10 for months. Punks are still Punks, Apes are still Apes... One small recent twist: Pudgy Penguins launched a shitcoin token on Solana. Other than that, nothing really new here.

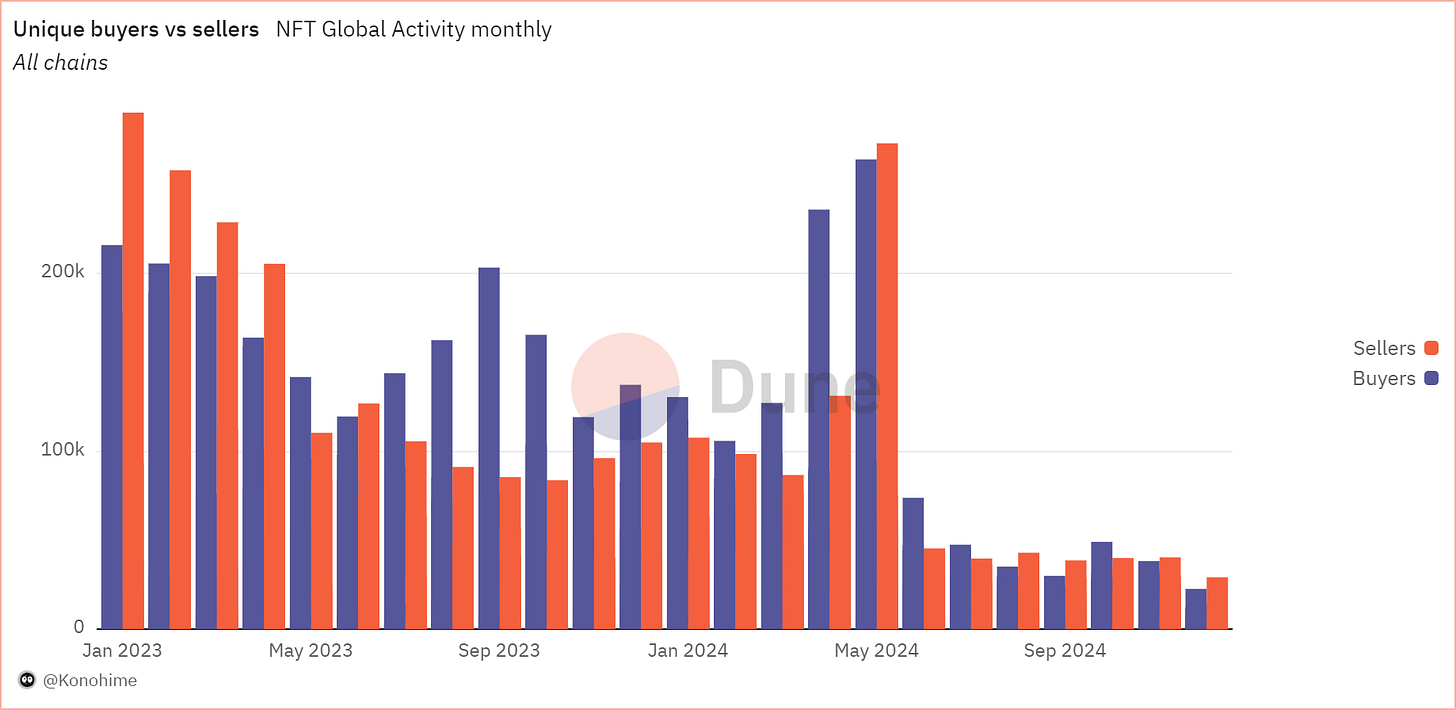

One interesting angle to consider is the activity of buyers and sellers across the major blockchains between October and November:

Ethereum : +19% buyers vs +1% sellers

Base : +13% buyers vs -20% sellers

Solana : -33% buyers vs -7% sellers

Polygon : +1% buyers vs -10% sellers

While buyers outnumbered sellers in October, that trend didn’t hold in November and seems to be worsening in the early weeks of December. What can we conclude about this so-called NFT market “recovery”? Sellers appear to be capitalizing on the crypto momentum to offload their NFTs at relatively high prices, continuing the tradition of maintaining USD volume on ETH.

When it comes to new mints, all eyes are on Base. Increasingly, projects are launching via the Farcaster protocol, leveraging Frames (interactive on-chain windows integrated directly into news feeds). OpenSea regularly highlights collections launching on this L2. Despite the relative failure of Coinbase’s two Onchain Summer events, it’s clear that Base is becoming a preferred choice.

My NFT Valuator

I wanted to share some of my coding progress, in case it interests you. I sincerely believe that evaluating NFTs is critical for maintaining a healthy market. While most people I’ve spoken to think the floor price is enough, whales emphasize the importance of price history for accurate NFT valuation.

Given my work in the ecosystem revolves around evaluating whale portfolios, I tend to agree with them on the methodology. That’s why I wanted to propose a simple tool for the community: an NFT Valuator: https://dune.com/Konohime/nft-valuator

Right now, it only covers two projects: CryptoPunks and CyberBrokers.

Nine days ago, my estimate for a Punk with three traits, type "Human," and gender "Female" was 45 ETH, or around $163k.

I wasn’t too far off! There’s still room for improvement since the estimate was slightly too low, but it’s very encouraging.

For CyberBrokers, I chose the “Human” species and the “Leftovers” class. These are the most common traits, and I was a bit surprised because the floor price for this collection struggled to exceed 0.1 ETH. And yet…

Given these very satisfying results, I’m planning to subscribe to Dune’s “Data Analyst” plan so I can upload more metadata. Which collections would you like to see evaluated?

Experimental onchain art: PostMortem World

Created by Teto and Tokenfox, I came across this rather unusual artistic project in the NFT ecosystem. Each collector must pay 0.1 ETH and answer 18 questions to receive a seed that will be revealed on December 13.

These questions pose a real ethical and moral challenge:

“As a doctor in an isolated village, would you let patients die from a lack of organs or accept organs from the black market?”

“Would you clear a forest to build solar panels or preserve the forest and keep using oil? “

Based on your choices, a morality score will be assigned to the NFT, and the resulting artwork will differ significantly.

Supply: 576

Price: 0.1 ETH

Website: https://postmortem.world/

Disclaimer: I own 2.

Thanks for reading this post! I’ve started my journey in the NFT ecosystem in 2018 with gaming. Then I became the head of content of NonFungible.com in 2020. Then Data Analyst in 2023. Now I write my thoughts and mint my art.

If you want to see my works :

Follow me on social networks: